AI Tax Calculator to

Maximise Your

Tax Return

Australia's first tax return

and tax refund maximiser app

powered by AI.

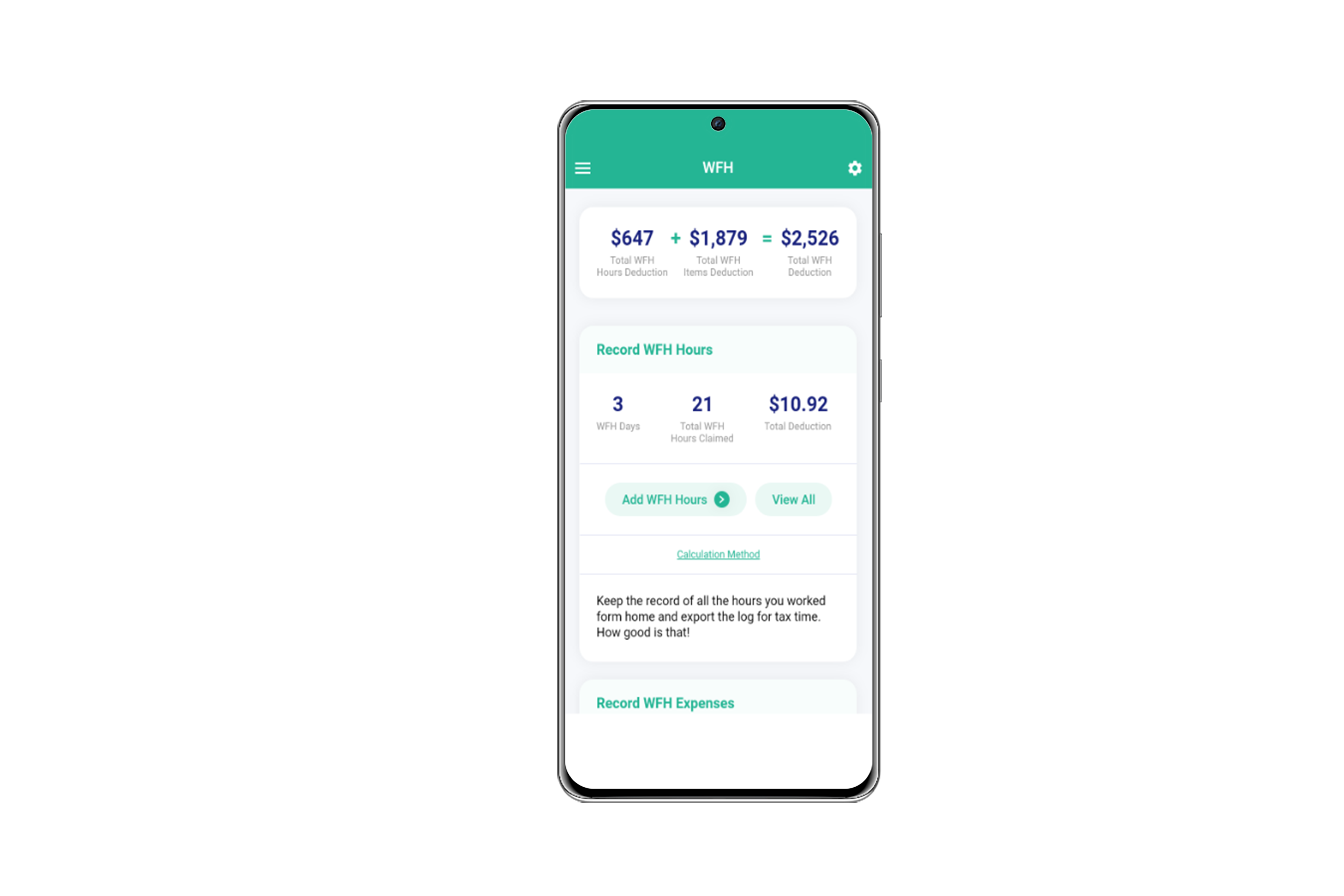

Watch your tax refund grow with every claim

Calculate your taxes the same way as your accountant and track it on a simple dashboard with our intuitive tax app.

Are you paying more tax than you need to?

The tax calculator shows you how much extra tax refund you could get by claiming the right deductions.

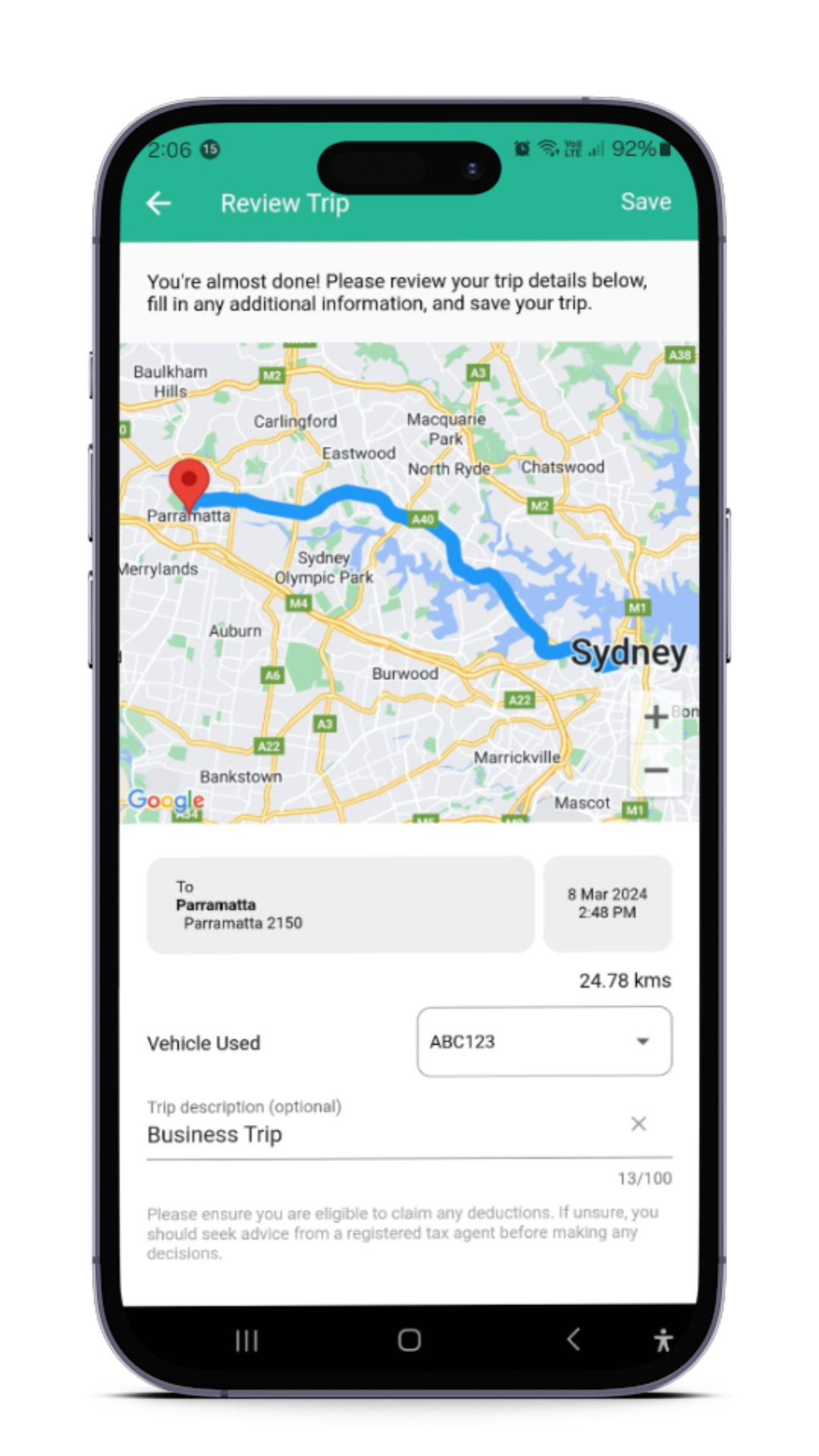

Effortlessly transform your device into a digital logbook for seamless mileage tracking.

Digital Vehicle Logbook

Let TaxFox automatically calculate your potential refund based on the distance you've traveled.

Auto-Calculated Tax Refunds by Distance

Receive a detailed analysis of your potential tax refund for each trip.

Trip-Specific Refund Breakdowns

Export professional tax reports in PDF format to showcase your digital logbook, distances covered, and potential deductions.

Generate Sleek Trip Reports

Save time, save money, lodge with confidence

Being well prepared means you save on accounting costs, time and get more tax refund!

How do you file your taxes?

Lodge your own Tax Return

Access the ATO My Tax portal through the app to file your own taxes

File your taxes using an accountant

Easily export all your tax info and receipts to send to your tax agent.

Save yourself the the mad rush during tax time

Save yourself the the mad rush during tax time

Take back control of your taxes

With the TaxReady Inbox as your guiding light.

Action items in your inbox guides you step by step to have all your taxes sorted.

Get prompts on what else you can do to maximise your tax refund.

Be alerted when the AI finds possible tax deductions that you can claim.

Say goodbye to physical receipts and spreadsheets

Say hello to digital receipts

Store your receipts digitally as a photo

Save or share directly from your mobile

Share zipped PDF files of receipts (.ZIP)

Download receipts and summary to Google Drive

$12B+

estimated to be unclaimed yearly and growing

80%+

Aussies feel like they have forgotten to claim a deduction they’re eligible for

$7.5B+

in deductions were missed, just in deductible donations

67%+

of individuals are not claiming deductions for donations they made

Chances are, you’re missing out

on eligible tax refunds every year

Australians are missing out on billions of dollars of tax refund every year. Are you one of them?

Have you ever wondered...

-

What kind of deductions can I claim for my job?

-

How much can I claim in each deduction category?

-

How much tax refund will I get this year when I do my tax?

Get Smart tax tips to see what expenses you can and can’t claim for your job

Get a checklist of what you can claim based on your job

Compare average deductions claimed by others in your occupation

Stop missing out on tax refunds

that you’re legally entitled to

Get your tax refund early

Complying with the Australian Tax Office (ATO) rules

has never been easier with the TaxFox Mobile Tax App.

With enhanced app features the ATO guidelines are easy to follow.